Leasing Your Club Car

A guide to leasing or buying Turf Vehicles

THE CASE FOR LEASING TURF VEHICLES

Turf Vehicles have historically been purchased like mowers and equipment, as opposed to leasing or financing like trucks and heavy equipment. In going the capital acquisition route, buyers can be limited by tight annual budgets and competing needs often leading to fewer vehicles being procured than are needed. Worse yet, limited budgets lead to the repurposing of older vehicles that require more maintenance costs and are not as efficient leading to higher costs. In addition to higher costs, old Turf Vehicles run the risk of spending more time being repaired leading to more downtime and reduced productivity.

BUY AND HOLD….IT WORKS FOR STOCKS RIGHT?

There is evidence that buying quality items and holding on to them for a long time can provide tremendous value or ROI (return on investment). For example, if you had bought one $40 share of stock in Coca-Cola in 1919 during its initial public offering, your one share would be worth $394,500 today. All you’d have to do is wait 100 years! However, buyers must consider Total Cost of Ownership. Think about that box full of VHS tapes and DVDs in the closet (not your closet, of course). For the cost of those fifty movies purchased at $15 each, you could have rented hundreds movies. So clearly, some things are worth buying and holding while others are clearly worth renting. In the case of Turf Vehicles, the route might not be as clear, but there are many options no matter the direction chosen.

THE OPTIONS

History shows that Turf Vehicles are predominately budgeted for annually and usually purchased with cash because most decision-makers do not realize there is an option to lease or finance. When speaking with many superintendents, the first reaction often to the question, “would you like a lease quote” is, “we don’t lease”. In most cases, a sales professional will just drop it at this point. Yet, by probing further it is likely that the buyer can in fact lease or finance the purchase, they just need to be open to a new process or open to extending existing processes to a new category of procurement. In doing so, both buyer and seller may come to the conclusion that there is in a way to reduce costs, increase productivity, improve safety, and reduce other operational costs through leasing or financing. What’s holding many buyers back is not the ability to lease or finance, but the willingness take the additional measures necessary to do so, and thus may be leaving a logical alternative on the table. Of course, before making any decisions on the method of procurement, it’s important to have a solid understanding of the pros and cons of each, so let’s review.

CAPITAL ACQUISTION AKA “THE STATUS QUO”

Buying new Turf Vehicles has its benefits. New vehicles need little maintenance, perform at their best, and often have warranties from 1–4 years depending on the brand and the components covered. CAPEX also may have beneficial tax implications based on your location, but as always, check with your tax advisor first. Whether you’re the decision maker or are required to go through procurement, for everyone involved a cash transaction is likely to be the easiest. The biggest challenge for simply “cutting a check” is having the dedicated funds for that purchase in the first place. Budget dollars may have initially been planned for specific spend on Turf Vehicles, but given the nature of budgets, things change and that bucket may either be empty by the time you need it or coopted for more pressing needs.

FINANCING AKA “WHAT YOUR MOM OR DAD WOULD TELL YOU TO DO”.

Financing of Turf Vehicles, sometimes called a Conditional Sales Contract, is a way to avoid large upfront costs, while still maintaining control of the asset at the end of payments. Like buying outright, there may be certain advantages to financing your purchase especially if the vehicles you finance are intended to last 8 or more years. That’s a tall order for some Turf Vehicles but if well maintained and properly used, not outside the norm.

FAIR MARKET VALUE LEASE AKA “RENTING”

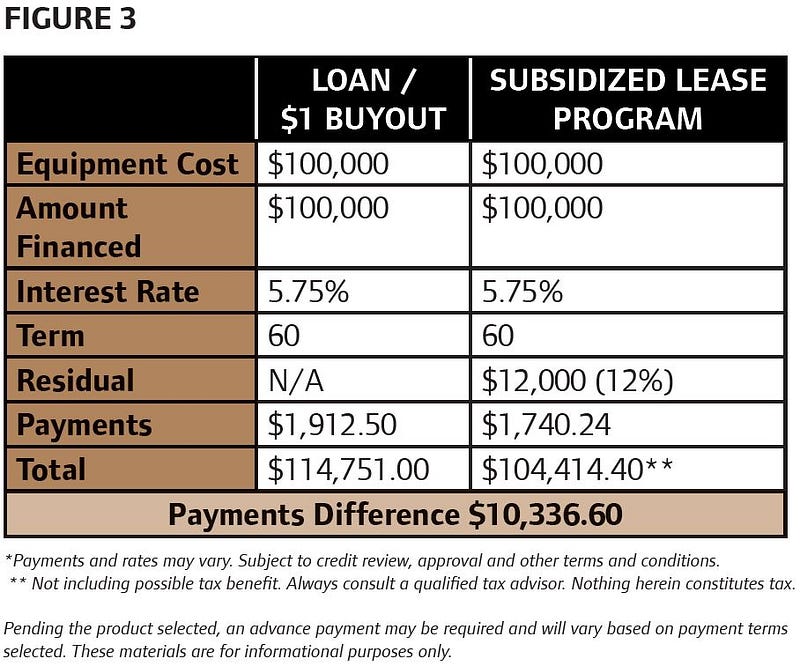

An FMV lease is essentially a long term rental with a set period, a set payment, a set interest rate, and a residual value that may enable you to buy the vehicle at the end or turn it in for new equipment. An FMV lease often requires no upfront cost (payment in arrears) and can be structured so that the payments match your needs. In other words, longer term, lower payments, and the shorter the term the sooner you can swap for new vehicles with newer technology. Many can also be structured to match seasonality of cash flow for example if your course relies on seasonal customers March — September, you could structure a lease where no payments are due January — March. An FMV lease provides a lot of flexibility, but as with a financed deal, it does require a lot more paperwork and ground game at the start. That said, the extra effort at the beginning could save your course thousands of dollars over the life of the lease as demonstrated in. Simply put a FMV lease allows for the greatest flexibility and improved cash flow allowing more cash to be on hand for other opportunities.

OTHER CONSIDERATIONS AND FINAL THOUGHTS

It is important to note that regardless of the type of transaction, purchase, finance, or lease, the manufacturer’s warranty is not affected. In the end, the supplier and dealer is happy just to have you as a customer. The question is will you have the ability to be a customer, because as we all know budget plans change, priorities change. Financing or leasing your Turf Vehicles can help you execute your transportation strategies without the fear of losing the resources you need to procure them.

Visit www.ClubCar.com for more information.

Comments

Post a Comment